All Categories

Featured

Table of Contents

Level term life insurance policy is just one of the least expensive insurance coverage alternatives on the marketplace since it uses basic defense in the form of survivor benefit and only lasts for a collection time period. At the end of the term, it runs out. Entire life insurance policy, on the other hand, is substantially a lot more costly than level term life due to the fact that it does not run out and includes a cash money value feature.

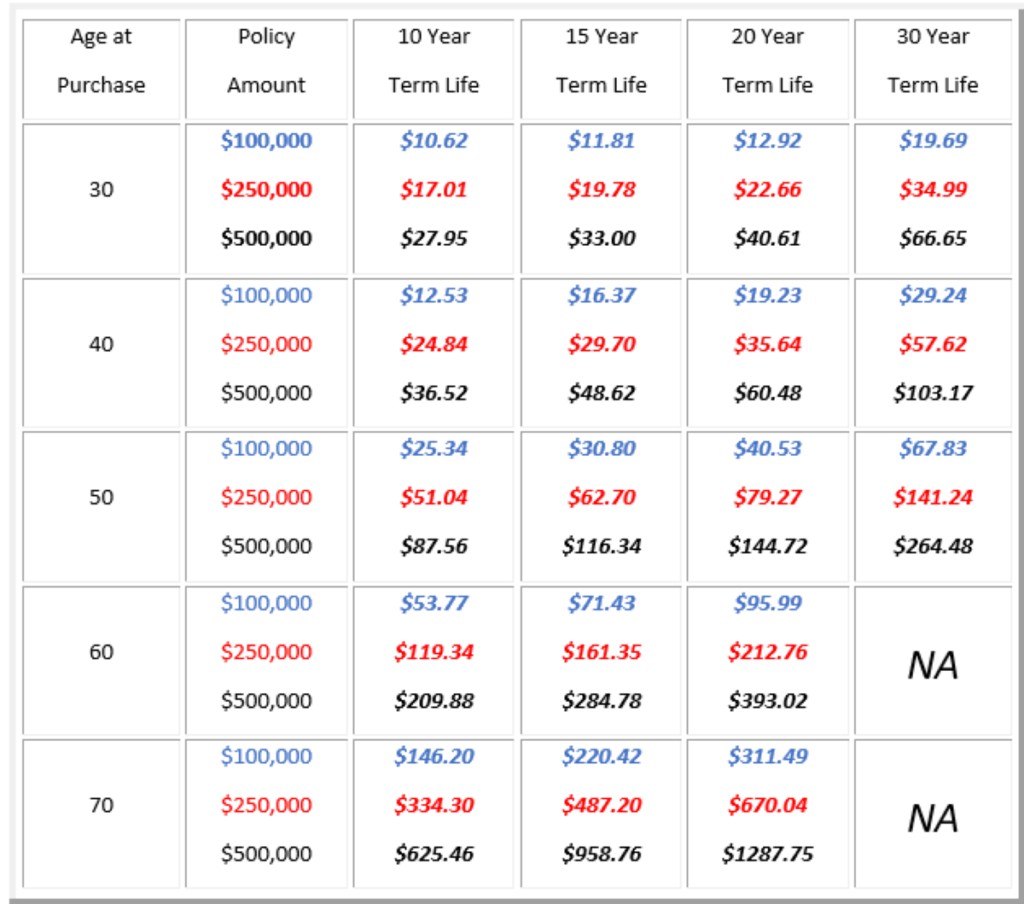

Rates might vary by insurance company, term, protection quantity, health and wellness course, and state. Level term is a terrific life insurance policy option for a lot of individuals, but depending on your protection requirements and personal situation, it could not be the finest fit for you.

What should I know before getting Level Term Life Insurance Rates?

Yearly renewable term life insurance policy has a regard to just one year and can be renewed yearly. Annual renewable term life premiums are at first lower than degree term life costs, but rates rise each time you renew. This can be a great alternative if you, as an example, have just give up smoking cigarettes and require to wait 2 or three years to obtain a degree term policy and be qualified for a lower rate.

With a decreasing term life plan, your survivor benefit payout will lower in time, but your settlements will stay the exact same. Reducing term life plans like mortgage protection insurance policy typically pay to your lender, so if you're looking for a plan that will pay out to your loved ones, this is not an excellent fit for you.

Boosting term life insurance coverage policies can help you hedge versus rising cost of living or plan monetarily for future children. On the various other hand, you'll pay more ahead of time for much less insurance coverage with a raising term life plan than with a level term life policy. If you're not certain which sort of plan is best for you, dealing with an independent broker can aid.

What does a basic No Medical Exam Level Term Life Insurance plan include?

As soon as you've chosen that degree term is best for you, the following action is to buy your plan. Below's exactly how to do it. Calculate just how much life insurance policy you require Your coverage amount must offer for your family members's long-term financial demands, including the loss of your income in the occasion of your fatality, in addition to debts and daily costs.

As you try to find methods to secure your economic future, you have actually most likely encountered a large selection of life insurance alternatives. Choosing the ideal coverage is a big decision. You intend to find something that will certainly assist sustain your loved ones or the reasons essential to you if something happens to you.

Lots of people lean toward term life insurance coverage for its simpleness and cost-effectiveness. Level term insurance, nevertheless, is a type of term life insurance coverage that has consistent repayments and an imperishable.

What is the best Best Value Level Term Life Insurance option?

Level term life insurance policy is a part of It's called "degree" due to the fact that your premiums and the benefit to be paid to your enjoyed ones continue to be the same throughout the contract. You will not see any kind of modifications in cost or be left questioning its value. Some agreements, such as annually sustainable term, may be structured with costs that enhance with time as the insured ages.

They're identified at the beginning and remain the same. Having regular settlements can help you better plan and budget plan because they'll never change. Best level term life insurance. Repaired death advantage. This is also evaluated the start, so you can know precisely what survivor benefit amount your can expect when you die, as long as you're covered and up-to-date on premiums.

How much does Level Term Life Insurance cost?

This commonly between 10 and thirty years. You accept a set premium and death benefit throughout of the term. If you die while covered, your survivor benefit will be paid out to liked ones (as long as your costs are up to date). Your beneficiaries will certainly understand beforehand how much they'll obtain, which can assist for preparing functions and bring them some monetary safety.

You may have the choice to for another term or, more probable, restore it year to year. If your agreement has an ensured renewability condition, you might not need to have a new clinical test to keep your coverage going. Your costs are likely to boost due to the fact that they'll be based on your age at renewal time.

With this choice, you can that will certainly last the remainder of your life. In this case, once more, you might not require to have any kind of brand-new medical examinations, but premiums likely will increase due to your age and brand-new insurance coverage. Different business provide various alternatives for conversion, be sure to recognize your choices prior to taking this action.

The majority of term life insurance policy is level term for the period of the agreement duration, but not all. With lowering term life insurance, your fatality advantage goes down over time (this kind is typically taken out to especially cover a long-term debt you're paying off).

Level Term Life Insurance For Families

And if you're set up for eco-friendly term life, then your premium likely will rise each year. If you're checking out term life insurance policy and wish to make sure simple and foreseeable monetary defense for your family, degree term may be something to take into consideration. However, similar to any kind of kind of coverage, it might have some restrictions that do not fulfill your demands.

Usually, term life insurance is a lot more cost effective than long-term coverage, so it's an economical means to safeguard financial security. At the end of your agreement's term, you have numerous choices to proceed or relocate on from coverage, commonly without needing a medical examination (Level term life insurance policy options).

What is included in No Medical Exam Level Term Life Insurance coverage?

As with other kinds of term life insurance coverage, as soon as the agreement finishes, you'll likely pay greater premiums for coverage because it will recalculate at your present age and health. Degree term uses predictability.

That does not indicate it's a fit for every person. As you're purchasing life insurance policy, right here are a couple of crucial factors to think about: Budget plan. Among the benefits of degree term protection is you recognize the expense and the survivor benefit upfront, making it less complicated to without fretting about rises with time.

Age and wellness. Typically, with life insurance policy, the much healthier and younger you are, the extra budget friendly the coverage. If you're young and healthy, it might be an enticing choice to secure in reduced premiums now. Financial responsibility. Your dependents and monetary responsibility contribute in establishing your insurance coverage. If you have a young family members, for circumstances, level term can help offer financial backing throughout crucial years without paying for insurance coverage longer than required.

Latest Posts

How do I apply for Level Term Life Insurance For Seniors?

What is Joint Term Life Insurance and Why Choose It?

How do I choose the right Life Insurance?