All Categories

Featured

Table of Contents

- – What is the best Level Term Life Insurance Pro...

- – How long does Level Death Benefit Term Life In...

- – How much does Level Term Life Insurance Compa...

- – How do I cancel Level Premium Term Life Insur...

- – Can I get Level Term Life Insurance Policy O...

- – What are the top Level Term Life Insurance P...

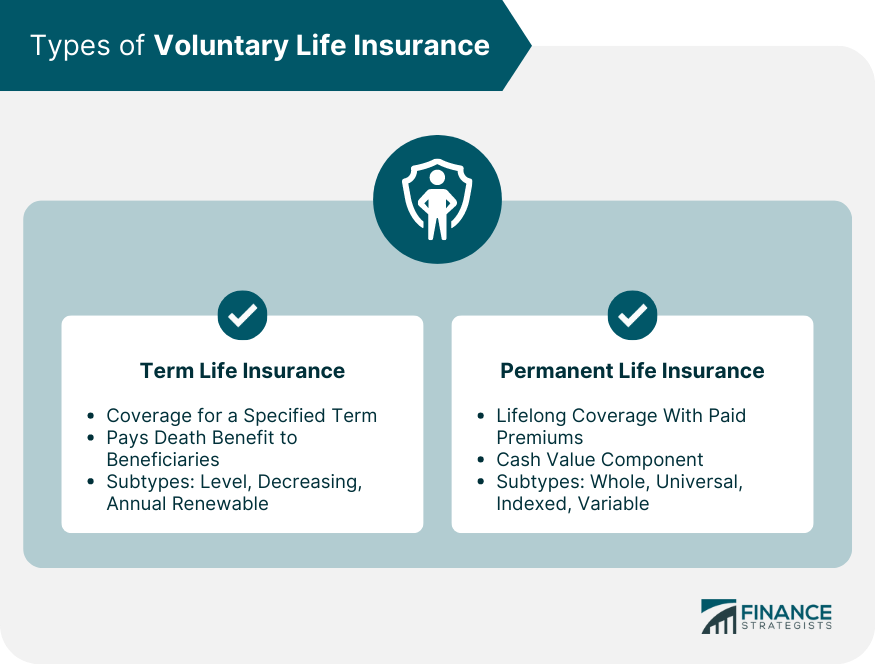

Term life insurance policy is a kind of policy that lasts a certain length of time, called the term. You pick the length of the plan term when you initially take out your life insurance policy.

Choose your term and your quantity of cover. Select the policy that's right for you., you understand your costs will stay the same throughout the term of the plan.

What is the best Level Term Life Insurance Protection option?

Life insurance policy covers most conditions of fatality, however there will be some exclusions in the terms of the policy - Level term life insurance quotes.

After this, the plan finishes and the enduring partner is no longer covered. Joint policies are usually more affordable than solitary life insurance policy policies.

This safeguards the purchasing power of your cover quantity versus inflationLife cover is a fantastic point to have because it offers economic defense for your dependents if the most awful happens and you pass away. Your loved ones can also use your life insurance coverage payment to pay for your funeral service. Whatever they pick to do, it's wonderful assurance for you.

Degree term cover is excellent for fulfilling day-to-day living costs such as household costs. You can also use your life insurance policy advantage to cover your interest-only home mortgage, repayment home mortgage, school costs or any type of other financial debts or continuous repayments. On the other hand, there are some disadvantages to degree cover, compared to various other sorts of life policy.

How long does Level Death Benefit Term Life Insurance coverage last?

Words "degree" in the expression "level term insurance policy" suggests that this kind of insurance policy has a fixed premium and face quantity (survivor benefit) throughout the life of the plan. Put simply, when people speak about term life insurance, they commonly refer to level term life insurance policy. For the majority of individuals, it is the simplest and most inexpensive option of all life insurance policy types.

The word "term" right here describes a given variety of years during which the degree term life insurance policy remains energetic. Degree term life insurance policy is just one of the most prominent life insurance policy policies that life insurance policy companies provide to their customers because of its simpleness and cost. It is additionally easy to contrast degree term life insurance policy quotes and obtain the very best premiums.

The system is as adheres to: Firstly, select a policy, survivor benefit quantity and plan duration (or term length). Second of all, select to pay on either a month-to-month or annual basis. If your early death happens within the life of the plan, your life insurance provider will pay a round figure of survivor benefit to your fixed recipients.

How much does Level Term Life Insurance Companies cost?

Your degree term life insurance policy expires once you come to the end of your policy's term. Choice B: Get a new degree term life insurance coverage policy.

FOR FINANCIAL PROFESSIONALS We have actually created to give you with the finest online experience. Your current web browser may restrict that experience. You might be using an old web browser that's unsupported, or setups within your internet browser that are not suitable with our site. Please conserve on your own some stress, and upgrade your browser in order to watch our site.

How do I cancel Level Premium Term Life Insurance?

Currently making use of an updated web browser and still having problem? Please provide us a call at for more assistance. Your present internet browser: Detecting ...

If the plan ends before your death or you live beyond the policy term, there is no payout. You might be able to renew a term policy at expiration, however the costs will certainly be recalculated based on your age at the time of revival. Term life is usually the least pricey life insurance offered because it offers a survivor benefit for a limited time and doesn't have a money value component like permanent insurance coverage has.

As you can see, the very same 30-year-old healthy and balanced man would pay approximately $282 a month. At 50, he would certainly pay $571. Whole Life Insurance Policy Fees 30 $282 $247 40 $382 $352 50 $571 $498 60 $887 $782 Resource: Quotacy. Quotes are for a $500,000 permanent life insurance policy policy, for males and females in excellent health.

Can I get Level Term Life Insurance Policy Options online?

That reduces the general threat to the insurance company contrasted to a long-term life plan. The decreased threat is one variable that enables insurance companies to bill reduced costs. Passion rates, the financials of the insurance firm, and state laws can likewise influence costs. In basic, companies frequently offer far better rates at the "breakpoint" coverage degrees of $100,000, $250,000, $500,000, and $1,000,000.

He gets a 10-year, $500,000 term life insurance policy with a premium of $50 per month. If George passes away within the 10-year term, the policy will certainly pay George's beneficiary $500,000.

If he lives and restores the policy after 10 years, the premiums will be higher than his initial plan because they will certainly be based on his existing age of 40 as opposed to 30. Level term life insurance quotes. If George is identified with a terminal health problem throughout the very first policy term, he most likely will not be qualified to renew the policy when it expires

There are a number of types of term life insurance. The finest option will certainly depend on your specific scenarios. The majority of term life insurance has a level premium, and it's the type we've been referring to in many of this article.

What are the top Level Term Life Insurance Policy Options providers in my area?

Therefore, the costs can end up being prohibitively pricey as the insurance holder ages. Yet they may be a great option for somebody that needs temporary insurance. These policies have a fatality advantage that declines each year according to a fixed routine. The insurance holder pays a dealt with, level costs throughout of the policy.

Table of Contents

- – What is the best Level Term Life Insurance Pro...

- – How long does Level Death Benefit Term Life In...

- – How much does Level Term Life Insurance Compa...

- – How do I cancel Level Premium Term Life Insur...

- – Can I get Level Term Life Insurance Policy O...

- – What are the top Level Term Life Insurance P...

Latest Posts

Funeral Cover Companies

Funeral Advantage Insurance

Instant Quotes Term Life Insurance

More

Latest Posts

Funeral Cover Companies

Funeral Advantage Insurance

Instant Quotes Term Life Insurance