All Categories

Featured

Table of Contents

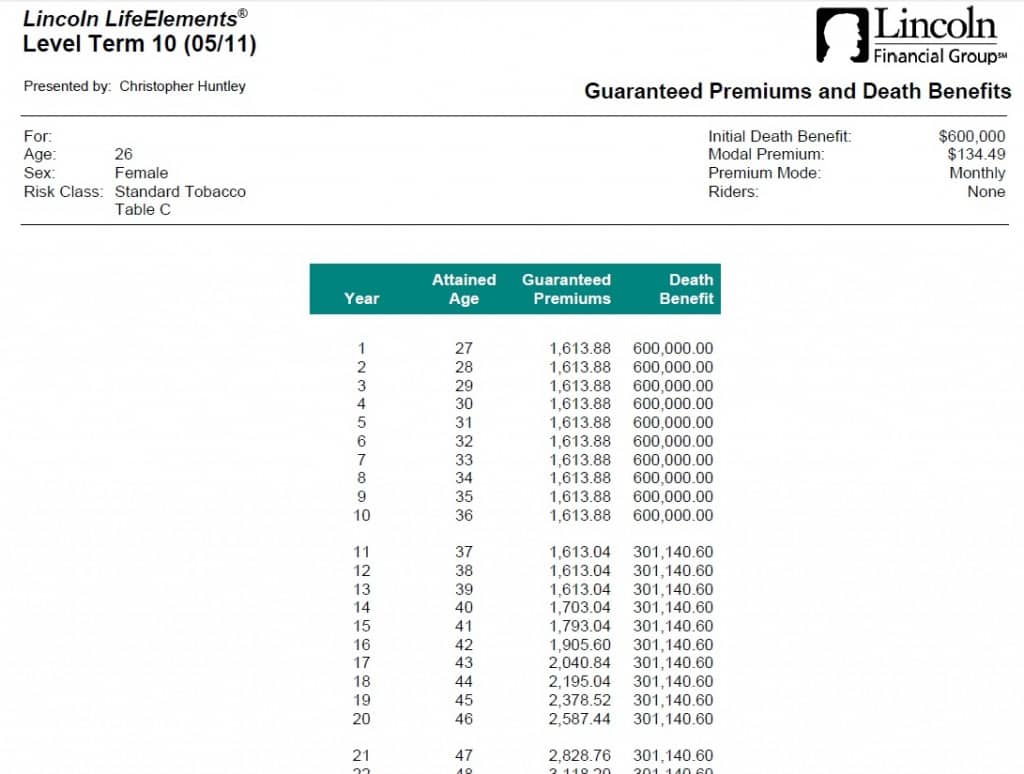

A degree term life insurance coverage policy can give you assurance that individuals who depend upon you will certainly have a death benefit throughout the years that you are preparing to support them. It's a method to aid take treatment of them in the future, today. A level term life insurance policy (in some cases called degree costs term life insurance policy) policy gives coverage for a set number of years (e.g., 10 or 20 years) while maintaining the costs repayments the very same throughout of the plan.

With level term insurance, the cost of the insurance policy will stay the very same (or potentially decrease if dividends are paid) over the term of your policy, usually 10 or two decades. Unlike long-term life insurance policy, which never ever runs out as long as you pay premiums, a level term life insurance policy will end at some factor in the future, usually at the end of the duration of your level term.

All About Direct Term Life Insurance Meaning Coverage

Due to the fact that of this, many individuals make use of irreversible insurance coverage as a steady monetary preparation tool that can serve many needs. You might have the ability to convert some, or all, of your term insurance coverage during a set period, commonly the initial ten years of your plan, without needing to re-qualify for protection even if your health has actually altered.

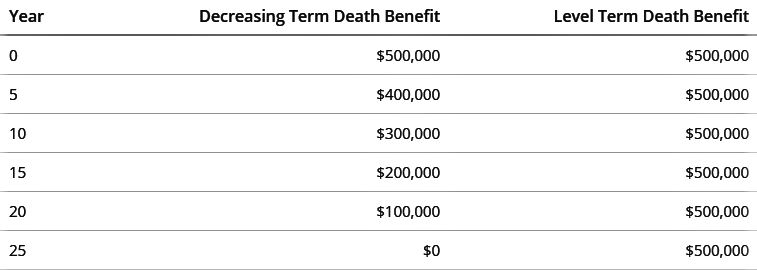

As it does, you might intend to include to your insurance coverage in the future. When you initially obtain insurance policy, you may have little savings and a large home mortgage. Eventually, your savings will certainly grow and your home loan will certainly shrink. As this occurs, you might intend to ultimately decrease your survivor benefit or take into consideration converting your term insurance coverage to a permanent policy.

As long as you pay your costs, you can rest very easy understanding that your loved ones will certainly receive a survivor benefit if you pass away throughout the term. Many term policies enable you the capability to convert to permanent insurance coverage without having to take another health exam. This can permit you to make use of the additional benefits of an irreversible policy.

Degree term life insurance policy is one of the most convenient paths right into life insurance policy, we'll review the advantages and disadvantages so that you can select a strategy to fit your demands. Level term life insurance policy is the most common and standard kind of term life. When you're trying to find short-lived life insurance plans, level term life insurance is one course that you can go.

The application process for degree term life insurance policy is typically really straightforward. You'll fill in an application which contains general personal information such as your name, age, and so on in addition to an extra comprehensive survey regarding your clinical background. Depending on the policy you're interested in, you might need to take part in a medical exam procedure.

The short answer is no. A level term life insurance policy policy does not develop cash money value. If you're wanting to have a plan that you're able to take out or borrow from, you may explore permanent life insurance coverage. Entire life insurance policy policies, as an example, allow you have the convenience of fatality advantages and can accrue cash worth with time, implying you'll have more control over your advantages while you live.

How Does 20-year Level Term Life Insurance Policy Work?

Riders are optional provisions added to your policy that can offer you additional benefits and securities. Anything can occur over the course of your life insurance policy term, and you want to be all set for anything.

There are circumstances where these benefits are developed into your policy, but they can likewise be readily available as a separate enhancement that requires extra payment.

Latest Posts

Funeral Cover Companies

Funeral Advantage Insurance

Instant Quotes Term Life Insurance